Want to know how to get your house ready to sell?

Get our FREE easy-to-follow checklist.

If you’re considering selling your house in the Dallas Fort Worth area, and buying a new home, you’ve probably been noticing the headlines around real estate. But if you’re anything like us, you’ve probably learned to dig a little deeper than what the latest media headlines are saying. We’ve found that most times they take a snippet and do a terrible job at explaining what’s actually happening, or in some cases, like we’ve seen here lately, completely missing the mark. But even when we know that the headlilnes are misleading, we still have questions about whether it’s a good time to buy or sell.

Should you sell your house or buy a new home in the Dallas Fort worth area this year? What if prices fall or the market completely crashes? Selling your home and buying a new one can feel risky, no matter what real estate market we’re in. But only if you don’t have the right information and guidance. When you can find answers to your questions that give you peace about whatever decision you need to make, that’s when you can move forward. We’re here to bring you what’s actually going on in the Dallas Fort Worth real estate market, backed by real numbers, along with what we’re seeing, since we are actually in the market, helping real home sellers and home buyers every day.

Before we get into all the numbers of the current Dallas-Fort worth real estate market, we’d like to share with you a few ways on how we help our clients make decisions when starting their journey of choosing to sell and buy a new home.

1. First of all, we need to ask some important questions, and be really honest. There is alot of fear being pushed everywhere we look, so it’s easy to get caught up in the fear, what-if’s, and bad information when we aren’t really clear on why we want or need to move. Ask you and your family what this move will do for you. Will it improve your quality of life? Do you kids need to be in different schools? Would you like a bigger backyard? If you’re anything like us, we love being at home with our family. So having more space and a backyard with a pool was high on our priority list. Or maybe your house just no longer fits your needs. We had a two story home with only the primary bedroom downstairs, and our daughter hated being upstairs by herself. So finding a home with that extra bedroom downstairs was really important. And now it serves as a place for my Mom to stay when she comes to visit. You know, sometimes we get comfortable in the uncomfortable with the way we’re living, our lifestyle. But I can tell you by experience, that making a move to a better home and neighborhood has made a huge difference for our family. And we’ve seen it for so many of our clients.

2. The next step is actually talking with a reputable and experienced mortgage lender to see what things look like financially. It’s not a good idea to just plug some numbers into a mortgage calculator online, because it doesn’t take into account your credit rating and the other aspects that go into the final numbers. A great lender can look at what your goals are and give you best case scenarios, and together you can decide how you want to move forward. Looking at actual numbers gives you a much better idea of what’s possible, instead of you just assuming you can or can’t afford what you really want.

3. And finally, we all have to manage our expectations, the voices in our heads, and those around us, because sometimes making the decision to move can be a tough one. When we choose to focus on what we can control instead of what we can’t, decisions get much easer. We can’t control the economy, inflation, interest rates, or home prices. But we can reduce the risk by looking at what we can control. For instance, if you look at the history of real estate prices (see graphic below), you can clearly see that they continue going up. Even in the great recession, it only took about 3 years to recover here in the DFW metroplex. And for some here, it didn’t even take that long. There will always be people too afraid to ever make a change in life, but for those that are brave enough to look at what it will actually take to make the leap, the reward is living a life that you love. If you’d like to explore what your options are, reach out and we’ll be glad to help.

.png?w=1140)

Now let’s dive into home prices. According to Case-Shiller, home values at a national level went up most of 2023, but flattened out in December and January, which is pretty normal for that time of year. But we had an early spring market starting in February, which caused home prices to rise again. As a matter of fact, 18 of the top 20 cities Case-Shiller reports on in the monthly price index went up. And Dallas was on that list.

The latest stats show that the median home price in the DFW area is at $395,000, which is up just over 1% from the previous year. The number of available homes for sell is up by almost 35%, with the months of inventory creeping up to 3 months, which means we’re still in a seller’s market. Homes are sitting on the market for 53 days, which is 7 days less than the previous year. This is looking like a healthier market with more homes to choose from for a home buyer, and the prices aren’t jumping up by 18% like we saw back in 2021, or 15% like in 2022. The market is correcting and going back to a slower pace than what we experienced in those few pandemic-driven years.

But as you know, real estate is local. This is really a generic snapshot of the metroplex as a whole. Let’s get a little more granular with the four main counties in the Dallas Fort Worth market.

In Denton county, the median home price has increased by almost 6% to $465,000. Homes are taking 50 days to sell, which is 14 less than the previous year. The number of homes for sale went up by almost 31% and the months of inventory ticked up a little to 2.5. Now this months of inventory just means the amount of time it would take to sell every home currently on the market if no more homes came up for sale. That’s how we also gage whether we’re in a seller or buyer market. It’s about supply and demand. Right now, there is still alot of buyer demand for housing in the Dallas Fort Worth market, with 418 people moving to the area every day!

Let’s take a look at Collin county. The median home price actually decreased a little by 1-½% to $492,000. That equates to about $7,000. Available homes for sale increased by 51% and the months of inventory equaled that of Denton County at 2.5 months. And homes are taking 42 days to sell, which is 16 days faster than the previous year.

In Tarrant county, the median home price increased slightly by 1% to $344,000. The number of homes on the market increased by 29%, and the months of inventory is at 2.6. Homes are selling for 49 days, which is 8 days less than the previous year.

And over in Dallas county, the median home price increased by 7-1/2 % to $371,000. There are 42% more homes for sale, with 2,8 months of inventory. And homes are selling in 45 days, which is 2 days faster than the the previous year.

So, most counties are seeing price increases, with fewer days to sell and more homes coming on the market to choose from.

However, this again is a pretty broad look. What we’re actually seeing right now is that the market is varying quite a bit based on price range, location, and the condition of the home. For example, there is a very popular neighborhood here in Flower Mound where homes rarely go up for sale. One of our clients found a house in this neighborhood that they really liked. It wound up in a multiple offer situation and the house sold for $70,000 above asking price, which was more than what I advised our clients to offer, and more than they felt comfortable with giving as well. But thankfully we were able to find them a home just down the road that better fit their needs and price range. We’re noticing a trend of houses between the $650,000 to $2 million dollar price range are still bringing multiple offers and getting at or above list price. But it also depends on the condition of the home and location.

Now, let’s jump into another hot topic right now that is affecting home sales and affordability, and that’s mortgage interest rates.

You may have heard mortgage rates are going to stay a bit higher for longer than originally expected. And if you’re wondering why, the answer lies in the latest economic data.

When it comes to mortgage rates, things like the job market, the pace of inflation, consumer spending, geopolitical uncertainty, and more all have an impact. Another factor at play is the Federal Reserve (the Fed) and its decisions on monetary policy. And that’s what you may be hearing a lot about right now. Here’s why.

The Fed decided to start raising the Federal Funds Rate to try to slow down the economy (and inflation) in early 2022. That rate impacts how much it costs banks to borrow money from each other. It doesn't determine mortgage rates, but mortgage rates do respond when this happens. And that’s when mortgage rates started to really climb.

And while there’s been a ton of headway seeing inflation come down since then, it still isn’t back to where the Fed wants it to be, which is around 2%.

So, when Will Mortgage Rates Come Down? Based on current market data, experts think inflation will be more under control and we still may see the Fed lower the Federal Funds Rate this year. It’ll just be later than originally expected. A Chief Economist at the Mortgage Bankers Association, said in response to the Fed’s recent decision:

“ We expect mortgage rates to drop later this year, but not as far or as fast as we previously had predicted.”

In the simplest sense, what this says is that mortgage rates should still come down later this year. But timing can shift as new employment and economic data come in, geopolitical uncertainty remains, and more. This is one of the reasons it’s usually not a good strategy to try to time the market. An article in Bankrate gives buyers this advice:

“ . . . trying to time the market is generally a bad idea. If buying a house is the right move for you now, don’t stress about trends or economic outlooks.”

And we agree. Trying to time the market, with home prices, interest rates, and the overall economic outlook, is almost impossible.

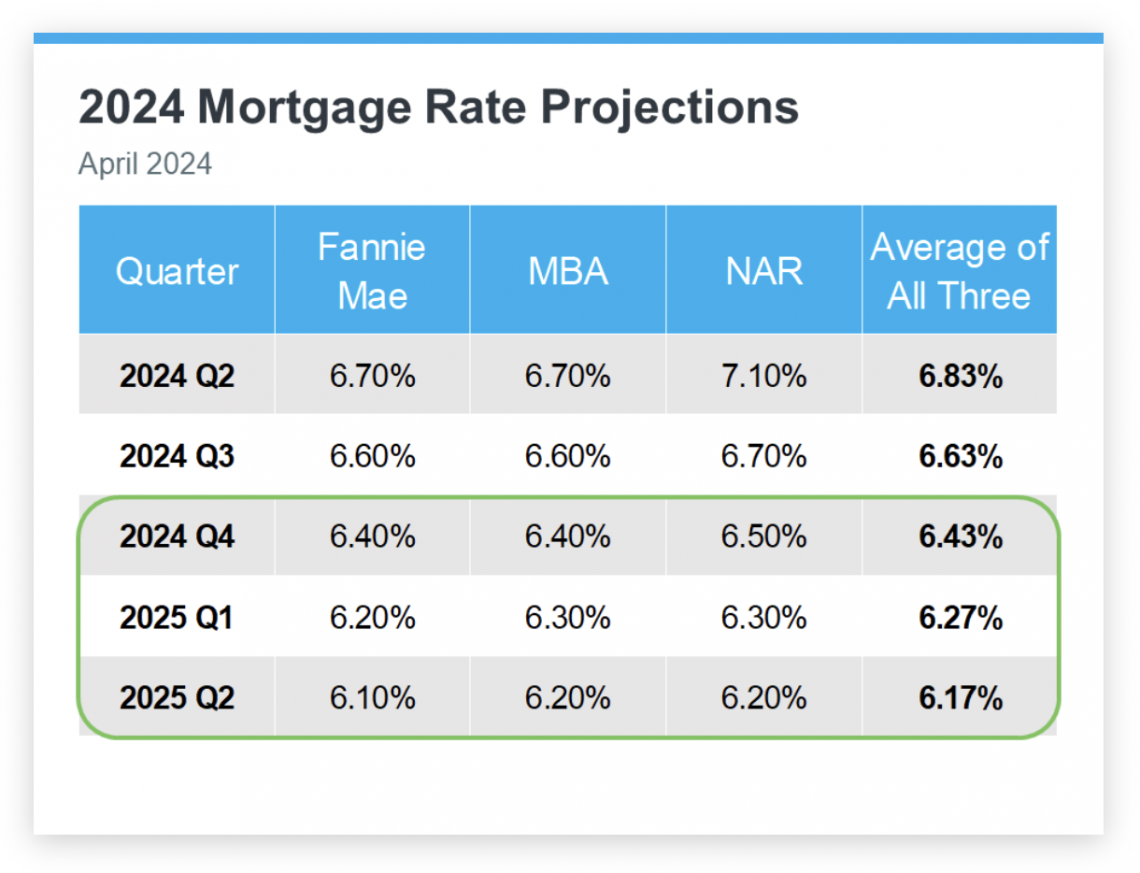

Just to give you an idea of what the rates look like right now and where they’re expected to go, Fannie Mae, Mortgage Bankers of America and National Association of Realtors all gave their predictions. The average of all three gives you an idea of what to expect. But let’s break this down to see what it actually looks like. For example, if you wanted to buy a house for $750,000, based on this chart, here’s how it breaks down. Now, these are extremely rough numbers and there are other factors at play, like your credit score, and other things. At a rate of 6.83%, the payments would be $4484 per month. That same house with the rate of 6.17 expected one year from now would have a monthly payment of $4223. That’s $261 a month lower. However, if home prices go up at the same rate they have over the last year in Flower Mound, that $750,000 house would now be priced at $792,750. Which would be a difference of only $24 per month. You can see that it’s not much of a difference.

I know we just went over alot of numbers, but we want to give you the actual numbers and facts so you can see for yourself what’s going on to make the best decisions for you and your family. So, let’s break this down now and talk about how this impacts you and what you need to know if you want to sell your house and buy a new home.

If you are considering buying a home, and you are ready, willing and able to, purchasing before prices go up even more might be a smart choice, since home values are expected to keep climbing. Each quarter, Fannie Mae and Pulsenomics publish the results of the Home Price Expectations Survey (HPES). It asks more than 100 economists, real estate professionals, and investment and market strategists what they think will happen with home prices. In the latest release, those experts say home prices are going to keep going up over the next five years.

And if you’re considering selling your home in the Dallas Fort Worth area, like we just talked about, prices are going up. There still aren’t enough homes available for sale right now compared to today’s buyer demand. So if you do the right things to position your house, you might receive multiple offers and sell quickly. This is something we have created a process for to help our homeowner clients know how to do. It’s a strategy we offer.

And for those of you who want to sell your house and buy a new home and are concerned about finding the right house and timing it all, we have several options available to make things much easier for you. As a matter of fact, a couple of our most recent clients loved being able to take advantage of buying their new home first before selling their current home. It took the pressure off of finding the right home, and also helped with moving their family out before putting their home up for sale.

If you want to know a little bit more about how to buy and sell at the same time, you can check out our next video below, or reach out to us directly for more details.